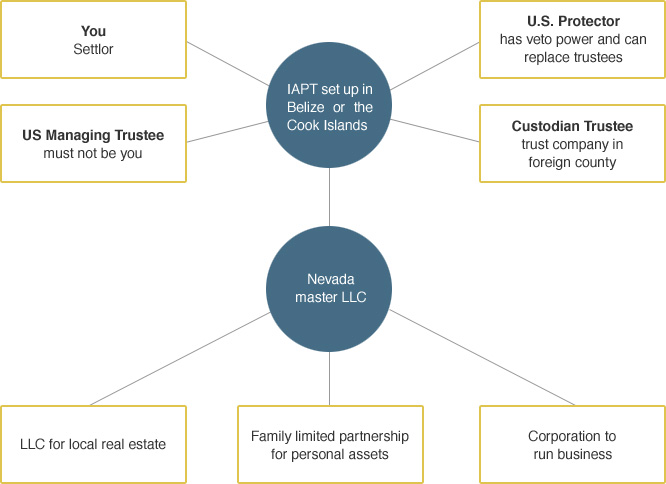

Sample of an asset protection trust set up. Please see comments below.

The next best thing International Asset Protection Trust (IAPT)

People frequently say “I want bulletproof asset protection.” I had an attorney friend of mine some years ago joke during seminars that the only true way to be bulletproof was to be poverty-stricken and destitute. Then he would go on to say that the next best thing to that was to form an International Asset Protection Trust (IAPT). This was 20 years ago. It was true then and it is still true today.

Many Foreign Asset Protection Trusts that are formed are actually hybrids. They are both in the U.S. and outside of the U.S. This allows for easy tax compliance and does not initially require any extra IRS or Treasury

Department reporting requirements

As long as an Asset Protection Trust meets the court and control test, it does not have any special reporting requirements. The court and control test, simplified, says that as long as the trust is controlled from within the U.S. and is subject to U.S. court jurisdiction it does not have to do any special reporting. Basically, it is a U.S. Grantor Trust.

Popularity of International Asset Protection Trusts (IAPT)

Over the past 20 to 25 years, IAPTs have become the most popular trusts for U.S. citizens to set up in foreign jurisdictions. The ease of annual administration is simple and inexpensive and they have been proven to have highly effective asset protection benefits. Essentially, at the time of formation, the Asset Protection Trusts are not offshore trusts. They are domestic trusts with the ability to become an offshore trust, if necessary.

Hybrid vs True Trusts

In reality, most trusts that are set up as hybrids never have to become true offshore trusts. The reason is that most creditors quickly back off once they find that an International Asset Protection Trust is in the picture. If the IAPT was set up long enough ago that there is no issue of a voidable transaction, then the creditor knows that an attack is futile. In fact, many creditors that could make a voidable transaction argument rarely do. It is simply too expensive for them to go down that path.

Elements of an International Asset Protection Trust

There are various elements to a trust that make it an International Asset Protection Trust. Although different people will have different definitions, these attributes are common in an IAPT.

- 1. It has a U.S. Managing Trustee

- 2. It has an offshore Custodian Trustee or Standby Trustee

- 3. It has a U.S. Protector

- 4. It has a foreign registration in an asset protection county

- 5. It states clearly in the trust document that the trust is a U.S. Grantor Trust for tax purposes

Choosing a managing trustee

Most clients want to be their own Managing Trustee. This is an absolute no-no. If you have this kind of control, it will immediately allow a creditor to get access to the trust assets. If properly done, a client can be the Protector if necessary. But even this position ideally should be someone else. The Custodian Trustee is a trust company in a foreign jurisdiction and normally an asset protection country such as Belize, the Cook Islands, or Nevis is used. These countries are considered asset protection jurisdictions because they have trust laws that support International Asset Protection Trusts and prevent any access to the trust or its assets.

Changing from an International Asset Protection Trust (IAPT) to a true foreign asset protection trust (FAPT)

As mentioned, the International Asset Protection Trusts are set up as U.S. Grantor Trusts at inception. However, in the face of a very aggressive creditor, the trusts can morph into a true foreign asset protection trust. Once that happens, there is no longer a U.S. Managing Trustee or a U.S. Protector. Thus, there is no U.S. presence and no U.S. court can gain jurisdiction over the trust. The Asset Protected Trust is now managed in a jurisdiction that has laws and policies that are favorable to the trust, the trust Settlor, and the trust assets.

Obviously, the trust document for an International Asset Protection Trust is a very specialized and finely tuned instrument. This is not something that is available “off the shelf” from a foreign trust company. There are no foreign trust companies that make this document available to the general public.